Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Wells Fargo & Company (NYSE:WFC) is about to go ex-dividend in just 4 days. The ex-dividend date is one business day before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade takes at least two business day to settle. This means that investors who purchase Wells Fargo's shares on or after the 2nd of November will not receive the dividend, which will be paid on the 1st of December.

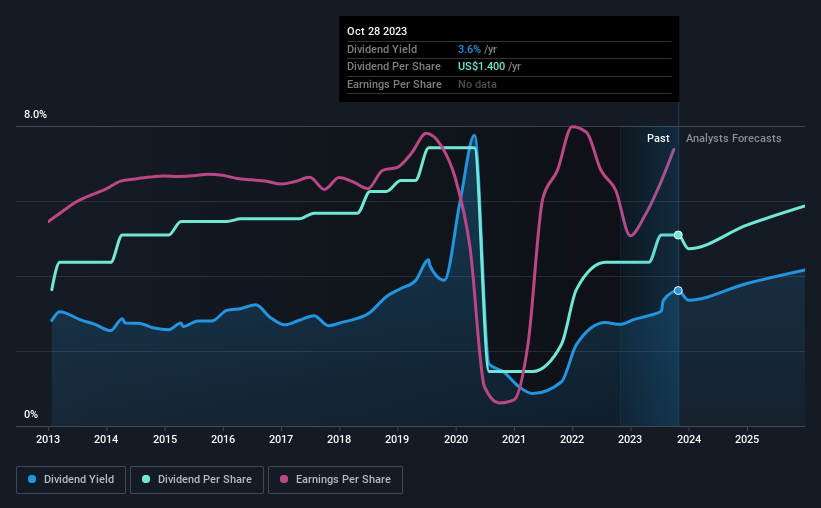

The company's next dividend payment will be US$0.35 per share, on the back of last year when the company paid a total of US$1.40 to shareholders. Based on the last year's worth of payments, Wells Fargo has a trailing yield of 3.6% on the current stock price of $38.76. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! As a result, readers should always check whether Wells Fargo has been able to grow its dividends, or if the dividend might be cut.

See our latest analysis for Wells Fargo

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. That's why it's good to see Wells Fargo paying out a modest 27% of its earnings.

Generally speaking, the lower a company's payout ratios, the more resilient its dividend usually is.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. This is why it's a relief to see Wells Fargo earnings per share are up 2.7% per annum over the last five years.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Since the start of our data, 10 years ago, Wells Fargo has lifted its dividend by approximately 3.4% a year on average. It's encouraging to see the company lifting dividends while earnings are growing, suggesting at least some corporate interest in rewarding shareholders.

To Sum It Up

Is Wells Fargo an attractive dividend stock, or better left on the shelf? It has been growing its earnings per share somewhat in recent years, although it reinvests more than half its earnings in the business, which could suggest there are some growth projects that have not yet reached fruition. Wells Fargo ticks a lot of boxes for us from a dividend perspective, and we think these characteristics should mark the company as deserving of further attention.

While it's tempting to invest in Wells Fargo for the dividends alone, you should always be mindful of the risks involved. For example - Wells Fargo has 1 warning sign we think you should be aware of.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

What are the risks and opportunities for Wells Fargo?

Wells Fargo & Company, a diversified financial services company, provides banking, investment, mortgage, and consumer and commercial finance products and services in the United States and internationally.

View Full Analysis

Rewards

Trading at 45.2% below our estimate of its fair value

Earnings grew by 13.5% over the past year

Risks

No risks detected for WFC from our risks checks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Author: Ricky Walker

Last Updated: 1699703762

Views: 2352

Rating: 3.8 / 5 (78 voted)

Reviews: 99% of readers found this page helpful

Name: Ricky Walker

Birthday: 1928-11-07

Address: 127 Larry Run Apt. 858, Hansenberg, WA 48785

Phone: +3773950310792175

Job: Social Worker

Hobby: Survival Skills, Baking, Amateur Radio, Cycling, Juggling, Beer Brewing, Bird Watching

Introduction: My name is Ricky Walker, I am a enterprising, courageous, welcoming, Open, resolute, esteemed, sincere person who loves writing and wants to share my knowledge and understanding with you.